Cinque Terre - 1483 Beach Ave

Vancouver, V6G 1Y3

Strata ByLaws

Amenities

Building Information

| Building Name: | Cinque Terre |

| Building Address: | 1483 Beach Ave, Vancouver, V6G 1Y3 |

| Levels: | 5 |

| Suites: | 5 |

| Status: | Completed |

| Built: | 2003 |

| Title To Land: | Freehold Strata |

| Building Type: | Strata |

| Strata Plan: | BCS801 |

| Subarea: | West End VW |

| Area: | Vancouver West |

| Board Name: | Real Estate Board Of Greater Vancouver |

| Management: | Royal Lepage Property Management |

| Management Phone: | 604-263-8800 |

| Units in Development: | 5 |

| Units in Strata: | 5 |

| Subcategories: | Strata |

| Property Types: | Freehold Strata |

Building Contacts

| Management: |

Royal Lepage Property Management

phone: 604-263-8800 |

Construction Info

| Year Built: | 2003 |

| Levels: | 5 |

| Construction: | Concrete |

| Rain Screen: | Full |

| Roof: | Other |

| Foundation: | Concrete Perimeter |

| Exterior Finish: | Concrete |

Maintenance Fee Includes

| Caretaker |

| Garbage Pickup |

| Gardening |

| Management |

| Snow Removal |

Features

| Fireplace |

| Juliette Balconies |

| Gourmet Kitchen |

| Luxurious Bathrooms |

| Hardwood Flooring |

| Bedrooms |

| Baths |

| Patio |

Documents

Description

Cinque Terre at 1483 Beach Avenue, Vancouver, BC V6G, Canada, BCS801. A 51-levels, 5 unit condominium was built in 2003. Cinque Terre condominium is lovated in West End Vancouver West, Vancouver. Close to Lord Roberts Elementary School, Robert Annex Elementary School, Elsie Roy Elementary School, Youth Learning Centre-Eslha7an Jr High School, Carson Graham Secondary School, King George High School, Kitsilano High School, FCC' TOLA' Child Care Services, Lord Robert YMCA Kids Club, Little Daycare, BMO Bank of Montreal, TD Bank Financial Group, Sunset Beach Park, English Bay Beach Park amd Morton Park. Crossroads are Beach Avenue and Nicola Street. Maintenance fees include caretaker, garbage pickup, gardening, management and snow removal.

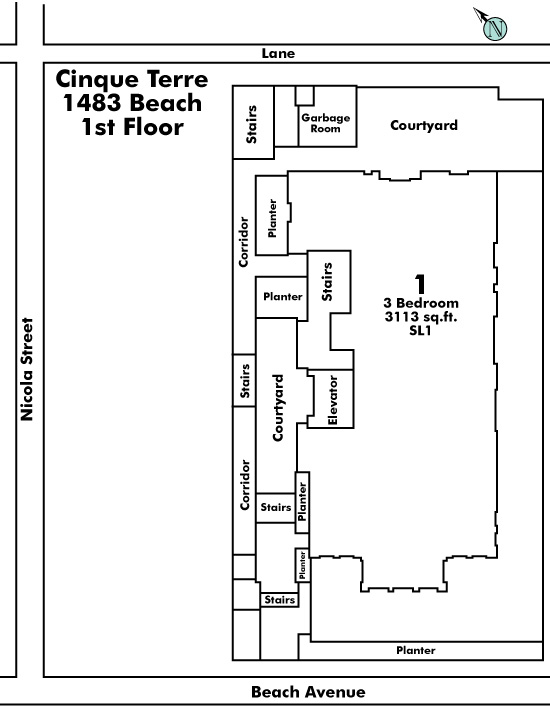

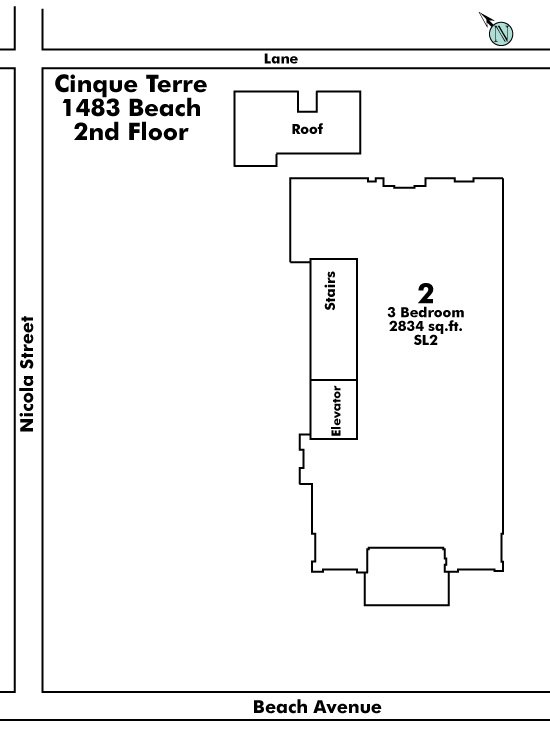

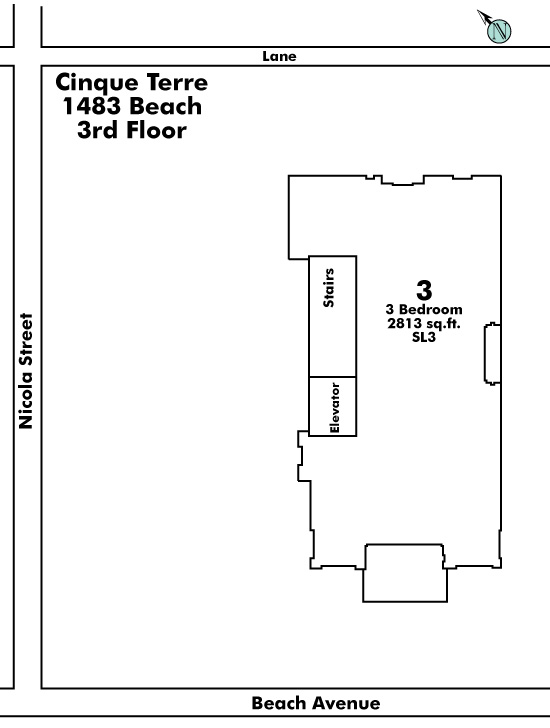

Building Floor Plates

Floor: 1

Floor: 2

Floor: 3

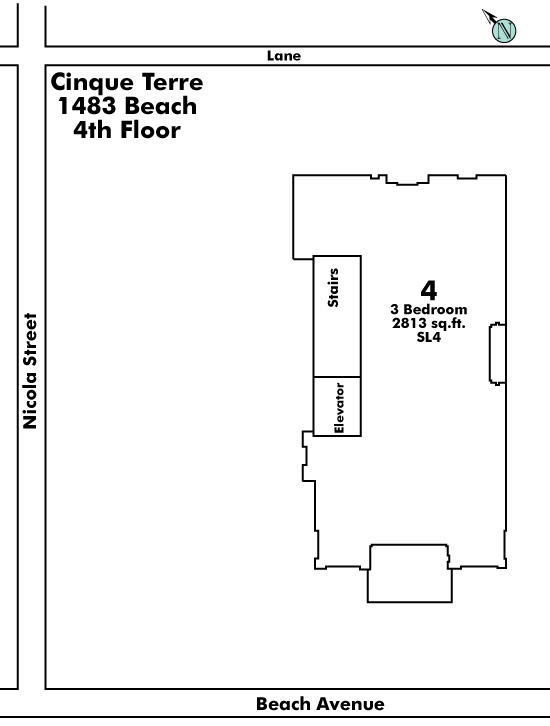

Floor: 4

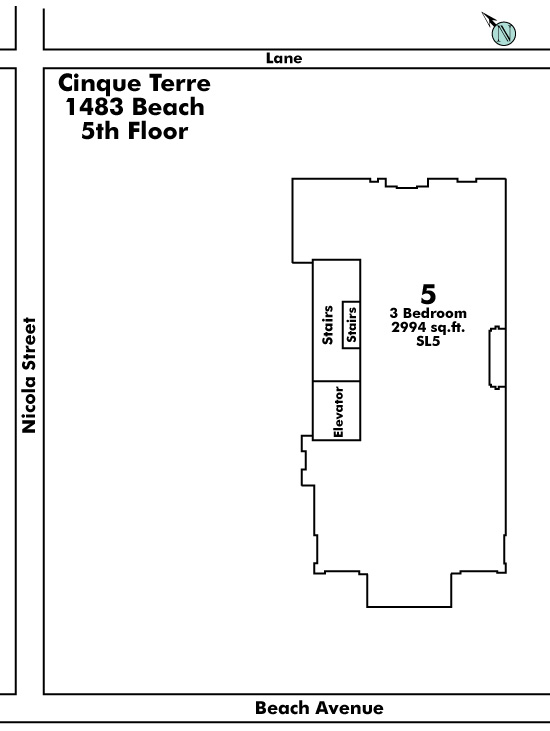

Floor: 5

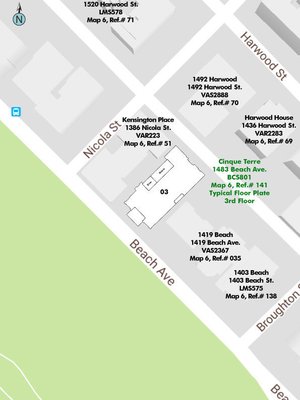

Nearby Buildings

| Building Name | Address | Levels | Built | Link |

|---|---|---|---|---|

| The Kensington | 1386 Nicola Street, West End VW | 6 | 1912 | |

| The Kensington Place | 1386 Nicola Street, West End VW | 6 | 1912 | |

| 1419 Beach | 1419 Beach Ave, West End VW | 9 | 1989 | |

| 1403 Beach | 1403 Beach Ave, West End VW | 5 | 1992 | |

| The Harwood | 1520 Harwood Street, West End VW | 8 | 1992 | |

| Ocean Vista | 1279 Nicola Street, West End VW | 5 | 1984 | |

| Linden House | 1280 Nicola Street, West End VW | 3 | 1987 | |

| St. Pierre | 1534 Harwood Street, West End VW | 1 | 1967 | |

| Harwood House | 1436 Harwood Street, West End VW | 9 | 1989 | |

| Tudor Manor | 1311 Beach Ave, West End VW | 22 | 1989 | |

| West End VW | 1558 Harwood Street, West End VW | 3 | 1986 | |

| 1558 Harwood | 1558 Harwood Street, West End VW | 3 | 1986 | |

| Dianne Court | 1315 Cardero Street, West End VW | 8 | 1957 | |

| Julia Court | 1406 Harwood Street, West End VW | 6 | 1985 | |

| Plaza Del Mar | 1575 Beach Ave, West End VW | 14 | 1967 | |

| Baycrest Apts | 1246 Cardero Street, West End VW | 3 | 1948 | |

| Vanier Court | 1355 Harwood Street, West End VW | 5 | 1975 |

Disclaimer: Listing data is based in whole or in part on data generated by the Real Estate Board of Greater Vancouver and Fraser Valley Real Estate Board which assumes no responsibility for its accuracy. - The advertising on this website is provided on behalf of the BC Condos & Homes Team - Re/Max Crest Realty, 300 - 1195 W Broadway, Vancouver, BC